Country Properties

6 Common Concerns of First Time Rural Home Buyers

Buying a rural property or country home can be intimidating. Arming yourself with knowledge and as much information about country living beforehand is the best way to feel comfortable and confident with buying this type of property.

In this article, we go over 5 of the most common concerns that first time rural home buyers have and dive into how you can overcome them.

1. Can I afford to buy this house?

A question asked by many people looking to buy a home, any home.

To answer this question it is essential that you speak with a mortgage broker (or your bank) to find out what price of the home you would be PRE-QUALIFIED for BEFORE you even start seriously looking for a country home to buy. This will give you an idea right off the bat what price range you can look in.

You can contact us for a list of trusted mortgage brokers and lenders.

Now, just because you can afford let’s say, a $900,000 country home, doesn’t necessarily mean you should buy one.

If buying a $900,000 home is going to put more strain on your finances, or worse if you are going to be living paycheque to paycheque in order to make the mortgage payments on this home, we would strongly recommend considering a more affordable rural home.

You can use this mortgage calculator to figure out an estimate for your monthly mortgage payments to help you get an idea of what you’ll need to budget for on a monthly basis.

Along with mortgage payments, you’ll have similar costs to what you’re used to in the city… property taxes, home insurance, utility bills (although these might be slightly different), as well as the added costs of maintaining your property and utility systems (more on that below). All things you’ll want to budget for.

If you need an outside perspective, consider talking with an accountant to analyse your income and expenses as well. You are welcome to contact us if you would like accountant recommendations.

This leads us to our second point that will continue to help answer the affordability question.

2. What costs are involved in the purchase?

To help you decide if owning a country home is something you can do, here are some costs you can account for. Using these estimates might help you to come up with a financial plan for the purchase of your rural home.

Land Transfer Tax – you will have to pay land transfer tax when you buy a home. To calculate an estimate of this cost you can visit our Land Transfer Tax Calculator page here.

Lawyer Fees – It can be difficult to accurately estimate these fees. The best thing to do is to contact your lawyer for an estimate. Typically we see fees being around $1,500-$2,500 depending on the property.

Home Inspection Costs – A home inspection for a country home can range from $400-$600 depending on the property.

Septic System Inspection Costs – Private septic system inspections in Ontario can range from $250-$420. This cost could be higher depending on how thorough of an inspection you decide to do or is possible.

Well & Well Water Inspection Costs – You’ll definitely want to have the well and well water checked out by a professional before making a rural home purchase. Typically with a well inspection, you are going to be testing for well capacity, flow pressure, and water safety/potability. You can expect to pay $150-$400 for a well inspection. This cost will depend on the type and number of well water tests you elect to do.

Title Search Insurance – It is not mandatory that you have title insurance when you buy a home in Ontario. However, most mortgage lenders require it if you are getting financing with them, especially when there is no property survey. This can cost $300-$500 depending on the property. This is usually only a one-time fee that will make up part of your closing costs.

Home Insurance – You can get an estimate of your home insurance by going online or speaking with your current home insurance provider. We cannot provide an estimate here because there are many factors that go into calculating the cost of your home insurance.

Property Taxes – You can get a pretty good estimate of what your taxes are going to be by looking at the country home listing. Often times the listing will include either the current or the previous years’ tax amount. You can also use a property tax calculator for the region you are searching for a home in, but these aren’t always 100% reliable.

A note on Commission Fees – There is a common misunderstanding with some new home buyers that they pay commission fees. This is not the case. The seller pays the commission to both the buying and selling agents. Unless some sort of agreement is made between you and your agent prior to the purchase you will not owe any commission fees.

3. Am I overpaying for the property?

There is no exact formula that you can come up with to answer this question for you. There are a lot of factors that go into deciding what price you can and should pay for a property.

Here are some factors that you can investigate so you feel more confident about the price you pay for your country home.

Market conditions

Ask yourself what the current market conditions look like. Are we in a seller’s market? A buyer’s market? A balanced market? What is going on in the economy? What are interest rates like? And so on. All of these factors (and more) are going to have an impact on what price you end up paying for the property. If we are in a seller’s market, you can expect to pay a premium for the property since there likely won’t be many other options to choose from. There could even be a chance that you end up competing for the property. If we are in a buyer’s market or one that is more balanced, you may be able to negotiate on the price.

Comparables / inventory / time on the market

Looking at recently sold listings (~ 6 months to date) can give you a good idea of what houses are selling for. As mentioned above, less inventory on the market means you have less to choose from and you may not be able to negotiate down on price as much as you might want to. If the property has been sitting on the market for some time it could be that a) It is overpriced or b) something is wrong with it that is not immediately apparent from the listing or c) we are in a buyer’s market and there are a lot of other homes to choose from, all of which give you an opening for negotiating on the price.

Now, rural homes are special and oftentimes unique from one to the other. In urban or suburban neighbourhoods, looking at comparables is essentially comparing apples to apples but with rural homes, this is often not the case. Also, a country property may have a particular feature that is more valuable to one buyer but maybe less so to others. The buyer who values a certain feature may be more willing to pay a higher price for this home than another buyer. This is something that needs to be accounted for when comparing sold rural listings to come to an agreeable offer price.

Neighbourhood

It is a good idea to know what neighbourhood you’re buying in. With country homes you don’t necessarily have “bad neighbourhoods” but there are certainly areas you want to be in and others you might not. The neighbourhood you want to be in will depend on where you want to be, what price range you are looking in and how important the perceived value of the area is to you.

For example, if you need to commute to Toronto but want to live in the Niagara Region, buying a rural home in Grimsby is going to be more valuable to you than say buying in Sherkston (Port Colborne), even though on average rural homes there might be slightly cheaper.

The Home and Property

Is it the right home and the right property for you? This is a question only you can answer. And you need to decide what you are willing (and of course, able) to pay to get the ideal home for you. We’ve had many clients that decide to purchase a cheaper property and put money and work into the home to make it ideal for them. Others are willing to pay more than asking in a competition setting because it is the perfect home for them. And some prefer to wait for the stars to align where the right property and the right price come together. All of which is perfectly fine! At the end of the day, the decision is ultimately up to you.

4. How much work is involved in maintaining the property?

We can’t really answer this question without knowing exactly what property we are looking at. Naturally, this is going to depend on the size of the property, how much of it is lawn vs. naturalised, the length of the driveway, the type of property and so on.

The best thing to do, once you have settled on a property, is to make sure you have all the equipment you will need to maintain the property. At times, the current owners will leave items behind such as a riding mower or snow blower if they don’t require it at their next property. We have a client / friend who got really lucky when he purchased a country where the previous owners left him a tractor!

If you have a lot of lawn you will definitely want to invest in a riding mower or budget for hiring out landscapers for the spring, summer and fall months if you prefer. If you have a 600 ft. driveway a tractor and plough is going to be a blessing in the winter months. Items like hoses, shovels, fencing tools and others depending on what your plans are for the property.

5. How do I manage the utility systems on a country property?

The two main systems you are going to need to get used to and learn to maintain will be your water and your septic systems.

We’ve done an article on caring for both systems (see links below). So we won’t be diving too deep here. In short, caring for your well and septic system involve firstly inspecting them before you even buy the rural home, secondly, preparing yourself with basic knowledge about the system, thirdly, using the systems properly and lastly making sure to conduct regular maintenance checks on these systems.

6. Is the country life the right lifestyle for me?

Living in the countryside can be a magical experience but at times it can also be hard work.

The good news is there are a variety of country lifestyles you can choose from to suit your needs. You can find smaller acreages closer to town so that you don’t have to change your life too drastically by your move. At the other end of the spectrum, if you want a more rural life, living far away from any city and don’t mind a 15-minute drive to get groceries, that option is available too. And there are many other options in between.

It is good to remember that, unlike the city, you may have to contend with things like septic system malfunctions, potential well issues, a larger lawn to maintain, often times a larger driveway to plough in the winter, driving further to get groceries, living further away from friends and so on. As we have said many times, this is a rewarding life but just remember to be mindful of all the aspects that come with this lifestyle.

Do you have any concerns about buying a rural home that we missed in this article? You can reach out to us any time and we’d be happy to answer your questions. Email us at [email protected].

First Quarter – 2020 – Rural Home Market Ontario Update

A quick look at the first quarter of the 2020 Rural Home Real Estate Market. This update covers the months of January to March, 2020.

In January, we finished up our 2019 Annual Rural Home Market Report (which you can read or download here). This report gives readers real estate market information specifically on rural homes and country properties around the Greater Golden Horseshoe area.

Below is a brief snapshot of the 2020 rural real estate market. Covering the Greater Golden Horseshoe.

2020 started off with a bang! The real estate market in all aspects of residential real estate was hot. We remained in a market heavily slanted towards sellers. Pent up demand and low inventory had home buyers feeling the pressure and competition between buyers was ramping up again.

This demand was evident in the overall increase in average sales prices across most major home markets around the GTA. The rural real estate market saw these increases as well.

Below are the average sales prices and the number of sold listings, comparing the first quarter or 2019 to the first quarter of this year (2020).

It is important to note that the averages listed in the tables below are based solely on RURAL and COUNTRY properties of 0.5 to 100+ Acres sold in the Greater Golden Horsehoe between January and March of 2020.

2020 Average Sales Prices & Sold Listings

| JANUARY | FEBRUARY | MARCH | |

| AVERAGE SALES PRICE | $966,382 | $937,990 | $886,845 |

| # OF SOLD LISTINGS | 115 | 223 | 272 |

2019 Average Sales Prices & Sold Listings

| JANUARY | FEBRUARY | MARCH | |

| AVERAGE SALES PRICE | $859,034 | $893,186 | $842,936 |

| # OF SOLD LISTINGS | 83 | 134 | 170 |

Both years saw a steady rise in the number of listings sold through from January to March. This is not uncommon. We often see as the weather warms up and we head in to spring, the real estate market is more active with listings and the number of buyers out and about searching for homes.

Despite continued low inventory as we moved into 2020, the average number of actual rural homes sold during these months was higher than in 2019. And this increase in the number of sales did not appear to be a result of lower-priced inventory. In fact, we saw an overall average sale prices increase of about 7.5% across these three months when we compared the two years.

Now, we are all aware that the stay at home order and the overall economic impact of COVID-19 is going to have, we hope, a temporary impact on the real estate market. How could it not?

We will be keeping a close eye on the rural home market over the second quarter of 2020 and will keep you updated on this through our monthly newsletter.

Don’t forget to check out our 2019 Rural Market Home Repot for here.

Caring For Your Well & Well Water

It can be a little intimidating to move to the countryside and have to contend with new utility systems.

Follow these care instructions and rest easy knowing you are doing your best to look after your well and well water.

Step one begins before you even purchase the home. We always recommend you get the well inspected and the well water tested.

Initial Inspection

When a well is dug, the installer will submit a record to the Ministry of Environment. This record is kept on file by the Ministry. The current owners should also have a copy.

An inspector often starts his/her inspection by obtaining this well record which will give them details about the well. Details like:

- Well Location

- The Age of the well

- Well Dimensions (depth, diameter, etc)

- Water levels (during pumping & when static)

During the inspection, the inspector will confirm that the well location is correct and away from any source of contamination. He/She will also make sure there are no cracks in the well casings, the drainage is working correctly, the well pump is working, screens are not broken, and more!

If possible, the water quantity is also checked to ensure there is no risk of the well running dry.

To get more in-depth information on well inspections, you can read more here from Builders Ontario.

Water Tests

Part of your due diligence on buying a property with a well is to ensure the water safe to use and drink.

To test the quality of the water, samples are sent off for testing. Tests can be done for things like E.Coli, Nitrate levels, Sodium levels, Lead and more. Again you can read more about well inspections and water tests here. A sample of the water is conducted at your local county or municipal office.

Once you’re happy with the well inspection and you move forward with purchasing the home, it is your responsibility to look after your well.

Maintaining Your Well

Here are the things you need to do to maintain and care your well:

1. Regular Check-Ups & Inspections are essential. Every 1 – 2 years ideally. This inspection will involve someone coming in to check the condition of your well, well equipment and so on.

2. Getting regular water tests is ideal. You’ll want to test your water for E.Coli every year and if possible, it is a good idea to have the Ph levels tested every 3 years. You can send water off for testing yourself here.

3. Monitor your water taste and smell. If anything smells or tastes “off”, you’ll want to contact an inspector immediately.

4. Keep contaminants away from your well (at least 100 ft.)

Contaminants include animal waste, fuels, surface waters, any type of pesticide or fertilizer.

5. Take a walk around your well site to see if you can hear any abnormal sounds being made by the pump. The pump should not be continuously running for example.

6. If you have a spill near your well, do not hose it down. You should instead get in touch with the contacts below:

Contact the person who did your inspection or who does your regular maintenance inspections.

OR

Ministry of Environment:

P. 1-888-396-9355 (WELL HELP)

P. 1-800-565-4923 (PUBLIC INFO)

E. [email protected]

For an in-depth understanding of your well and the best way to protect it, you can check out this great resource from Conservation Ontario here.

Preventing issues by keeping up with regular maintenance is a sure way to avoid big expenses down the road.

Caring For Your Septic System in Ontario

If you’re looking to live the country life, you’re going to need to get familiar with septic systems. This is essentially your sewer system.

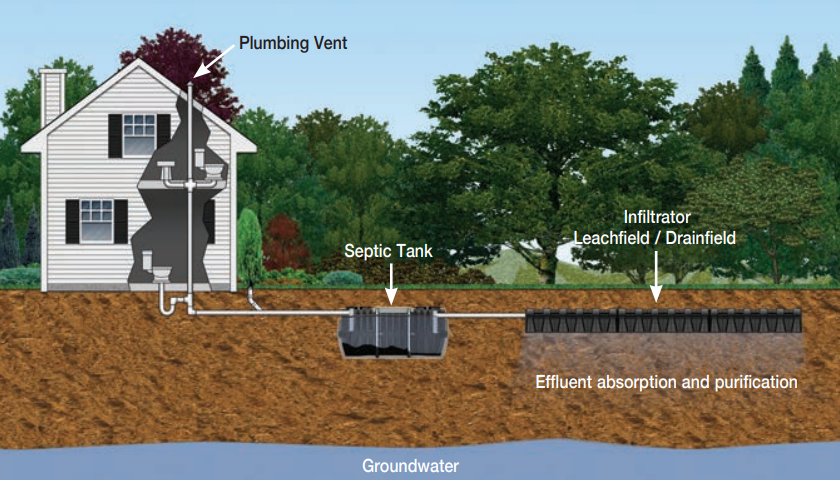

Waste from bathrooms, kitchen sinks, and your washing machine are all distributed through pipes to a septic holding tank where solids are held and liquids are separated. Light solids float to the surface forming a scum layer while heavier solids sink to the bottom of the tank. These solids remain in the tank until it is cleaned.

The separated liquids are sent to a leaching field where they filter through the soil before the remaining “cleaned” water seeps into the ground.

In this article, we are going to go over the very basics of caring for your septic system. If you want more in-depth details on septic systems here is an excellent document and guide to understanding Septic Systems by Builders Ontario.

Caring for your septic system starts with knowing its condition prior to firming up on a rural home.

Initial Inspection

Septic systems can be difficult to inspect. The septic tank is more times than not buried underground as are the pipes leading to and from the tank to the leaching bed. Inspectors typically inspect the site where the tank is located to see if there are any signs of a failing system, like a sewage smell or pooling/overly damp areas in the yard.

They might also do a Septic Tank dye test. In fact, your lender might request one.

If the dye test shows signs of leaking or a failing septic system you might need to go to the extent of pumping out the tank to do a more thorough inspection. This will depend on how badly you want the house and if it is worth going through to this level of inspection, knowing there is likely an issue with the septic system.

To get more information about the septic dye test, please visit an experts’ site here.

In a perfect world, the current homeowner would already have an up to date septic inspection when the house is put on the market for sale. At the very least they should know when it was last pumped and inspected. But in a seller’s market, this may not happen. Also, you might want your own septic inspection done for peace of mind.

Maintaining your septic system once you own the home

Now to the main point of this article. Caring for your septic system once you own the country home.

1. Regular check-ups and inspections. Depending on your household size, age of the system and tank size, your septic system should be inspected every 3 – 5 years. During these inspections, the inspector can determine when the tank needs to be cleaned out.

2. Know the location of your tank. This may sound blatantly obvious but it is important you know where you septic tank is located so take note of it during your inspection. The current buyer may have a survey showing the location of the tank as well, if not one can be requested from the city municipality office.

3. Maintain and keep all records. Drawings, inspection reports, etc.

4. Controlled flush or more efficient toilets can be more gentle on the septic system and are recommended where possible.

5. Spread laundry days throughout the week rather than doing many large loads on one day to allow time for the system to treat the waste.

6. The most important is disposing of your waste correctly. To keep it simple, don’t put anything in your toilet that isn’t human waste or toilet paper. No exceptions.

7. Don’t put anything over your draining field. For example, don’t park cars over your draining field and no planting trees on the leaching bed or even too close to it.

8. Make sure any water is drained AWAY from the draining field. For example, if you install a sump pump the installer will want to make sure it drains away from the leaching field.

9. Know the warning signs. Some warning signs of a malfunctioning septic system include a sewage smell in the yard, backing up toilets, slow draining in sinks and tubs, bacteria in your well water, surface water pooling in the yard, amongst others … If you notice any of these signs, call an expert immediately.

By taking care of your septic system and staying on top of maintenance, the less chance you have of running into an issue. Replacing a septic system is not cheap.

The 6 Best Places to Buy A Horse Farm in Ontario

If you’ve been wondering where to best places to buy a horse farm in Ontario are, check out our list of the 6 best towns to buy a horse farm below.

Ontario has an ideal countryside for horse properties. The rolling hills and grassy meadows set against tree-lined landscapes around the Greater Golden Horse Shoe are not only stunning but perfectly suited for horses.

We’ve chosen the following locations based on a few criteria that make these 6 areas worth buying a horse property in

- Reasonable real estate prices (for a horse farm!)

- An active real estate market with a number of horse farms currently for sale

- Proximity to all the horse essentials (available boarding facilities, shows, vets, farriers, etc.)

- Location suitability (soils, topography, water supply, etc.)

If you’re starting to explore the idea of buying a horse property be sure to explore these towns.

1. Flamborough, Hamilton Region

We begin our list in the gorgeous area of Flamborough. Situated at the northernmost edge of the Hamilton Region. The Niagara Escarpment winds through a big section of Flamborough presenting truly beautiful landscapes. To get an idea of the boundary, here is a link to a map of Flamborough.

You can find a great range of real estate options here. Horse farms and hobby farms, some ready for you to move right in and others waiting for your personal touch.

Real estate prices are relatively high here, with a $2,442,629 average. We think this is still somewhat competitive when compared to regions like York and Halton. You also seem to get more property for your dollar which is nice.

2. Pelham, Niagara Region

There are so many things that make the Niagara Region a prime spot to own any type of real estate. Good real estate prices, world-class natural beauty and prime farmland. The township of Pelham offers you an ideal countryside for equestrian living with the Niagara Escarpment as your backdrop.

There are a number of picturesque private facilities but boarding can be limited depending on your discipline. There is definitely a market for a high-end boarding facility in this region and Pelham would make an ideal spot. The average horse farm price from last year to date sits at $1,197,167.

Although it can be a bit of a hike to the bigger show venues, many riders here make it work. There are a number of local show venues as well as the Fort Erie Race Track nearby. Trips to the U.S. are also a breeze from Pelham.

There are plenty of opportunities to explore in Pelham.

3. Caledon, Peel Region

It goes without saying that Caledon is a hub of all things equestrian. Home to show venues like the renowned Caledon Equestrian Park and some of the most epic horse farms in the country.

Caledon is nestled in the Hills of Headwater, Niagara Escarpment and Oak Ridges Moraine which means the countryside offers impeccable views, trails and blissful days with your horses. Not to mentioned Caledon is situated close to everything you could need, be it racetracks, show venues, riding and boarding schools as well as excellent horse care professionals.

But views and easy access to all you need doesn’t come cheap. Horse farms in Caledon averaged a total of $2,517,643.

4. Mono, Dufferin County

Nestled in the heart of Headwaters Horse Country. Mono is an excellent option for those looking to buy a horse farm. It is a town that prides itself on the thriving equestrian industry here and does plenty to support the horse community.

The landscape is simply stunning – with acres of protected greenbelt, forested trails and sprawling meadows you can’t go wrong buying a horse property here. Well designed equestrian facilities and beautiful hobby farms make up a great deal of what the horse farm real estate market has to offer.

The average list price is currently $1,403,643. Reasonable considering you can find properties here that are surrounded by incredible natural beauty. As with the other areas, you aren’t far from major show venues, race tracks and top of the line boarding facilities.

5. Guelph/Eramosa, Wellington County

Just outside the city of Guelph lies a beautiful and charming rural section of countryside known as Guelph/Eramosa. Guelph/Eramosa neighbours Erin which is home to the renowned show venue of Angelstone Tournaments. Wellington Country offers excellent horse country in general, with boarding facilities run by top-level competitors and other horse related professionals never too far away.

Guelph/Eramosa encompasses the picturesque Guelph Lake Conservation Area. Meandering streams and acres of farmland are among the few things that make this an ideal spot to buy your horse farm.

The average equestrian property to date came in at $1,524,490. Making Guelph/Eramosa an excellent option for you to explore horse farms for sale here.

6. Burlington, Halton Region

The beautiful area of Burlington. In the heart of the Niagara Escarpment and centrally located to horse shows, race tracks and beautiful trails. Now, we know both Milton and Halton Hills also offer spectacular equestrian living but at this moment Burlington has a number of equestrian properties currently for sale but the other two do not. But you really can’t go wrong buying a horse farm anywhere in the Halton Region.

The average price comes in at $4,655,957 BUT the numbers are skewed by a couple of highly – very highly – priced horse properties. Using the median price of $2.9 Million is more realistic of what you can expect to pay for a horse farm in Burlington.

You can find high-end boarding facilities here, great hobby farms that could easily be converted into your dream horse farm. There are plenty of horse riding schools and you are never too far from luxury estates.

Winding country roads and forest sanctuaries make Burlington an excellent choice for horse home seekers.

Some of you may be wondering why we didn’t include the York Region in this list.

It meets the beautiful landscape criteria, is close to all you need and offers top-class equestrian properties. The trouble is, real estate prices here are high and you don’t often get a lot for your money. Unless you are looking at horse properties over $4 Million, barns are run down and the homes often need work. That is not to say that you can’t find your perfect property here, it just might mean you have to wait longer and JUMP as soon as you see it.

All of the above locations offer classic horse country living options. Beautiful views, ideal typography and perfect proximity to all horsey essentials. Whether you have Olympic aspirations or just a desire to keep your horses at home, these places are worth exploring!

If you have any questions, you know you can always get in touch – we’re here to help.

* Average prices are based on the equestrian real estate market, current and sold listings from January 2019 to 20th January 2020.

5 Important Factors for Financing A Rural Home or Acreage

Financing a country or rural home doesn’t have to be complicated. Sure, there are many varying factors that go into getting approved by a lender. But we’ve got you covered. Here are the 5 main things you should get a grasp on when it comes to financing your dream acreage.

Lenders and Risk Analysis

If you’ve purchased a home before, or taken out a loan, you will know that lenders are major risk assessors. Combing through every bit of information they can get from you to assess you and your ability to pay the loan back. They then take a close look at the value of the property you’re hoping to buy. They want to make sure that if you were to default on a payment, they won’t have a tough time offloading the property.

The more risk the lender feels there is with a property, the tougher it will be to get an approval.

Image Courtesy of Mike Mozart.

When it comes to country and rural homes, these 5 factors can impact whether a lender is willing to lend (“risk”) on a subject property:

- Downpayment and Property Values

- Zoning

- Size of the Property

- Additional Infrastructure

- The condition of the home and residential improvements

Let’s dive into these 5 factors in a bit more detail.

1. Downpayment & Property Values

Less than 20% Down Payment

It is possible to buy a home with acreage using a 5% – 10 % down payment. Provided the property meets certain requirements. This is made possible through the residential CMHC insured lending program. Of course, with some restrictions which include (but are not limited to):

- The property being valued under $1,000,000.

- The property and house being in good (habitable) condition.

- The value of the property will be placed on the home, garage and put to 10 acres. No value is given to outbuildings (e.g. heated sheds, shops, barns, paddocks, etc.).

- The minimum downpayment starts at 5% for a purchase price of $500,000 or less. When the purchase price is above $500,000, the minimum down payment is 5% for the first $500,000 and 10% for the remaining portion.

- Acreages or rural properties in very remote locations are going to be harder to finance at less than 20% down.

More on rural downpayment financing can be found here.

20% or More Down Payment

As mentioned multiple times, you should have an easier time obtaining financing with a down payment of 20% or more. The other lending requirements will still apply here including zoning, property size and condition.

Acreages with a purchase price in excess of $1,000,000 will need a down payment of at least 20% – 25% or more.

2. Zoning

Zoning, in short, tells you what you can do with the property. i.e.: what its permitted uses are.

Rural Residential or Country Residential zoning should be relatively easy to finance if the property meets the bank’s specifications on the criteria listed above.

A property with agricultural zoning can be a bit tougher.

If there is only a single residence on the property and there have been no prior farming operations, agri-business or commercial operations carried out you should have an easier time getting financing.

However, the caveat to this is the size of the property. Sizing requirements or restrictions can play a significant part in the financing approval process with agriculturally zoned properties. More on this below!

Since the zoning of these types of properties can allow for some form of agricultural operation the bank will want assurances. They will want to ensure you don’t have plans to run a farm on the property with the intention of earning the majority of your income from this operation. This is one of the main reasons why sizing can be a big factor in the lender’s decision.

You may also be required to give a higher down payment on a property with agricultural zoning.

If you wanted to buy an actual farm or hope to buy a property on which to start up a farm, you will need a farm loan. This is a whole other kettle of fish with much tougher and more specific lending criteria.

3. Size of The Property

Typically a property under 10 acres can be financed similarly to any other residential property. The larger the property though, the tougher it can be to find a lender willing to lend on it.

Although it is not always the case, for properties over 10 acres, financing usually works as follows:

- Lenders often agree to lend on the residence plus 10 acres. Typically requiring a 5-20% downpayment depending on their perceived level of risk (i.e. your ability to pay the loan back, current debt, the state and location of the property and so on).

- The lender then values the excess acreage which they may require you to put down an additional down payment on (~ 50-70% of the appraised value on the balance of the acreage). Or they may simply require you to pay for the balance in cash.

Here is an example:

Let’s say you’re looking at putting 20% down on a 25-acre property priced at $1,000,000 with agricultural zoning. There are 10-acres of trees where the house and garage are located, and 15-acres of cleared pasture with an equipment shed. With a traditional residential mortgage, the lender will place most of the value on the first 10-acres with the house and garage. The remaining 15-acres and shed will have little value to a lender that is lending on the basis that the property is going to be a residential property. If once the lender appraises the property and they feel the value of the 10-treed acres with the house and garage are only worth $850,000, then you may be forced to come up with the balance in cash.

10-Acres: $850,000 x 20% = $170,000

Remaining 15-Acres: $150,000

This could mean a total of $320,000 in cash that you need to put down on the property.

This equals 32% downpayment. That is 12% more than the 20% you had initially planned for. You can see how the lender’s risk tolerance is starting to take shape!

It is important to note that this is VERY property and case dependant. There will be properties that are over 10 acres where the bank will be willing to offer regular financing options.

As mentioned earlier, zoning in conjunction with the size of the property will play a factor in lending approval here.

4. Additional Infrastructure

This point has to do with where lenders place value in a property, and where they don’t.

Let’s say you are looking at a property with an older century home that needs some updating. The property has a large detached garage, a brand new 4 stall horse barn on the property and new fencing. You might be excited by this find because to you, having the 4 stall barn is essential to what you want to do with the property… but your bank might not see it the same way.

Lenders often don’t put much value on outbuildings, barns, fencing and so on. Their main concern is going to be with the condition of the house and garage. The majority of their appraised value is going to come from these two buildings.

Even though the current owners of our example property above may have spent $20,000 on this new barn, and you feel the barn warrants this value in the asking price, the lenders likely won’t see it the same way or at the same value.

5. Condition of The House

The bank likely isn’t going to lend on a dilapidated house that isn’t fit for habitation unless you have spoken to them about a plan for renovations and they are involved in lending on the construction. This, of course, does add another layer of complexity but it is of course achievable.

The value of the property as it currently exists is going to play a big factor in the bank’s decision to give you a mortgage and for how much.

A home needing cosmetic updates is not an issue, provided the systems, and structural integrity of the home is intact.

You often find utility systems like a well and septic system on the property. The bank is going to want to see certification and proof that these systems are in good working order. For instance:

- Water Portability Certificate / Well Water Certificate – After a sample of the water has been tested as safe for human consumption, this certificate will be issued.

- Septic Certificate – will need to be provided for newly installed systems. For existing septic systems, the bank may ask to see a completed septic inspection report and this is something you will want to have for yourself regardless.

Replacing any part of a septic system or well can be extremely costly so doing thorough inspections during your due diligence period is very important!

Getting Started

Speak with a mortgage broker or your bank before looking at any rural homes. This way you can see what price range or property you are approved for.

Happy Home Hunting!

The 8 Most Popular Areas to Own a Country Home in Ontario

Ontario offers some truly spectacular countryside and rural living options.

Today we have put together a list of 8 of the most popular country living options around the Greater Golden Horse Shoe Area. Let’s get started!

Pelham, Niagara Region

- Average Sale Price (2019): ~ $850,000

- Proximity to Toronto: 1hr 30 – 2 hrs

- Natural Features: Shorthills Provincial Park. Comfort Maple Conservation

The entire town of Pelham offers excellent country living options. The community of Fonthill is where you will find most of your necessities. It has a country-chic downtown area that offers fine dining, artesian galleries, antique stores, and cozy cafes. The areas of Effingham / North Pelham, Ridgeville and Fenwick are your best bet for country and rural living. Carolinian forests and sprawling meadows are a staple in Pelham. The natural beauty provides a refuge from city life. With gorgeous estates on winding country roads, modest hobby farms and equestrian facilities – you can’t go wrong with buying a rural home in Pelham.

Read more about Pelham, Ontario here.

Campbellville, Halton Region

- Average Sale Price (2019): ~ $1,200,000

- Proximity to Toronto: 1hr – 1hr 10

- Natural Features: Nassagaweya Canyon, Mountsberg Conservation

Campbellville is another community we just adore. Located in the major town of Milton, this community is both quaint and charming. If you’re driving down Guelph Line towards this little village the scenery is sure to inspire. The community offers a wonderful countryside where you are never too far from equestrian facilities and horse farms. Not too far from the big cities of Toronto and Mississauga, Campbellville is a popular destination for tourists and well-off commuters. Located on the Niagara Escarpment, Campbellville offers homes with scenic views, upscale country estates, and forested retreats.

Campbellville | Halton | Courtesy of Campbellville.net

Read more about Campbellville, Ontario here.

Paris, Brant County

- Average Sale Price (2019): ~ $740,000

- Proximity to Toronto: 1hr 10 – 1hr 20

- Natural Features: Grand Valley River

A picture-perfect town nestled right where the Grand Valley River and Nith River meet. Historic architecture meets modern delights in the romantic downtown area of Paris. Enjoy fine dining, cafes, delectable bakeries and world-class architecture. Possibly one of the most enchanting little towns in the country, you will feel at ease living in the countryside here with spectacular scenery and picturesque natural landscapes. This riverside town offers many opportunities to enjoy the outdoors as well. You are sure to find yourself a charming century home or classic country paradise in Paris, Ontario.

Paris | Brant | Courtesy of Brant County

Read more about Paris, Ontario here.

Carlisle, Hamilton Region

- Average Sale Price (2019): ~ $1,150,000

- Proximity to Toronto: 1hr

- Natural Features: Carlisle Conservation Area. Bronte Creek

I adore the quaint community of Carlise. We used to keep our horses at a gorgeous barn here and driving through the little community always made you feel at peace. This is somewhat of an exclusive community because of its size and higher-end real estate prices. Carlisle is the classic small town with only a handle full of stores; two corner stores, a restaurant and a mechanics shop making up the downtown. We highly recommend the sweet treats at Carlise Bakery and the Cider from West Avenue Cider on Concession 8. For gorgeous country homes, ranch-style farmhouses and upscale rural living be sure to check out the community of Carlisle.

Read more about Carlile, Ontario here.

Elora, Wellington County

- Average Sale Price (2019): ~ $1,020,000

- Proximity to Toronto: 1hr 20 – 1hr 30

- Natural Features: Elora Gorge. Elora Quarry.

Elora is a delightful community with rolling hills, acres of farmland and historic charm. As picturesque as picturesque gets, this spectacular little village is perched at the edge of Elora Gorge. The site of limestone cliffs that descend gracefully into the Grand and Irvine Rivers are truly a natural beauty to behold. If you love nature and adventure, Elora could just be the countryside spot you’ve been yearning for. Modern marvels, Character homes and stunning country retreats can all be found in Elora.

Elora | Wellington County | © Mark Stephenson at Flickr

Read more about Elora, Ontario here.

Mono – Dufferin County

- Average Sale Price (2019): ~ $1,060,000

- Proximity to Toronto: 1hr – 1hr 15

- Natural Features: Mono Cliffs Provincial Park. Island Lake Provincial Park.

Mono is a rural haven of impeccable scenery, meandering streams, and majestic forests. As is to be expected from any small town traced by the Niagara Escarpment. Offering a large section of protected land it is no wonder Mono makes up a large section of “horse country”. From close-knit communities to secluded living, Mono offers many options for the country home and rural life seeker. Buyers looking for picturesque farms, a quaint country home surrounded by trees or large rural estates would find the ideal property here.

Mono | Dufferin County | Courtesy of Emily Mills at Flickr

Read more about Mono, Ontario here.

Creemore, Simcoe County

- Average Sale Price (2019): ~ $1,050,000

- Proximity to Toronto: 1hr 40 – 1hr 20

- Natural Features: Noisy River Provincial Park.

Creemore is a small community located in the larger township of Clearview. Being nestled within the Niagara Escarpment means you can expect world-class natural beauty at every turn. Welcoming neighbours, an inviting, red brick massed building downtown and weekly farmers markets make for a perfect country community. Here, you can find rejuvenated log homes, classic country homes, and private escapes when you are looking for a home in Creemore.

Read more about Creemore, Ontario here.

Jordan, Niagara Region

- Average Sale Price (2019): ~ $1,037,000

- Proximity to Toronto: 1hr 5 – 1hr 20

- Natural Features: Balls Falls Conservation. Twenty Mile Creek

OK yes, we are back in the Niagra Region for a second time but we could not leave this gorgeous community off of the list. Jordan provides quintessential country living at its finest! With a chic downtown area offering spectacular stores, restaurants and galleries. Jordan is a village surrounded by wineries, orchards and the beautiful Niagara Escarpment to the North. The unique micro-climate here allows for excellent fruit and wine production so be sure to visit some of the Twenty Valley Wineries and Pick-Your-Own Fruit stands. From modern country mansions to modest country escapes, be sure to visit Jordan for your country home purchase.

Jordan Village | Niagara | Courtesy of Jordan Village.ca

Read more about Jordan, Ontario here.

7 Essential Things to Consider Before Buying a Rural Home

The benefits of living in the countryside seem endless. Peace and quiet, less light, air and noise pollution. Stunning views, wildlife and a chance to do more with your property.

We were recently visiting friends the other night who’s home sits atop the Niagara Escarpment in Pelham. During an early evening stroll through their property, we saw a family of whitetail deer run through the wooded section of their property – just lovely!

Here are 7 things you should consider before making the move to a rural home.

1. Your Plans For The Property.

Do you hope to raise animals on the property? Build a small barn or large storage facility? Make sure to check with your municipality that you can go ahead with these plans BEFORE you buy the home.

The two most common restricting forces you could run into when wanting to make changes have to do with zoning and conservation.

a) Zoning by-laws

Existing zoning and zoning by-laws place by municipalities can have an impact on:

- How you use your land

- What type of structures you can have on the property

- Where structures are placed on the property

- Specific use restrictions (e.g. size of your property and the number of livestock animals you can keep there)

b) Conservation Authorities, or the Ministry of Natural Resources & Forestry

These authorities can also have an impact on what you do with and on your property. Especially as country homes are oftentimes located in protected areas (like the GreenBelt). Restrictions might be anything from what you build on your property, the animals you keep to restrictions on cutting down or altering trees.

2. How Far Away is Too Far?

You’ll definitely want to consider how far away from your current home is too far! Having to make a 10+ minute drive back into town because you forgot to buy milk might not sound too bad but after it happens a few times, it can get frustrating.

Being that much further away from friends may mean you don’t see them as often as you did before. And going out for dinner can feel like a task when you have a 20-minute drive back home.

If the school bus doesn’t have a route passed your new home you may have to drive your kids to a spot that the bus does come to or drive them into school altogether.

Although, in our opinion, the benefits of living in a rural home completely outweigh the concerns of being too far.

Nowadays it is also possible to buy a country home that is not too far away from all the amenities you might love about city life. It all just depends on you and the lifestyle you prefer.

3. Types of Utility Systems

You can find country homes on the outskirts of town that are connected to local municipalities – making the transition from city to country living a breeze.

However, the majority of countryside or rural homes on the market today have some sort of utility system that you don’t see in town.

In short, drinking water systems often come from wells or cisterns. Your sewer system is often a septic system with some sort of absorption or leaching bed. Heat can be produced by propane, occasionally electric or an oil type system as well.

For more information on these types of systems, you can read this article here.

4. Living Next To Operating Farms

Often times living in the countryside is glamorized by large manicured lots with grand estates, where the neighbouring farm has cows dotting the hillside, an adorable little farmhouse and red barn that tie it all together. Don’t get me wrong, with the right budget we can probably find this for you but sometimes living near operating farms can take some getting used to if you have always lived in the city.

A few years ago we kept our horses at a barn in Wainfleet and right next door was a farmer’s field. Every summer the farmer would fertilize his field with a very (VERY!) pungent-smelling fertilizer. It was chicken manure fertilizer. I spent a lot of time on a dairy farm with my best friend growing up, I can handle animals smells of all kinds but this would definitely take some getting used to.

You might be changing the sounds of traffic and fire trucks for machinery operating in the early hours of the morning and more dust. Most people are fine with this but occasionally some are not.

I only bring this up as a point because we have heard a few stories of people being unhappy living beside a farm and have tried to make complaints against the farmer (silly I know). Farmers are an integral part of our community and we always want to make sure our clients know what they are getting into before we make an offer.

5. Road Accessibility

It is a good idea to look into how accessible the road getting your property is year-round.

This typically won’t be a problem if you live close enough to town but it is not uncommon to find that rural roads may not be plowed in the winter by the municipality or if they are, they are plowed last.

In more rural settings, sometimes private companies are contracted out to plow these roads for you, with the neighbours who live on the same road often sharing this cost. Sometimes the road can remain unplowed for days depending on the amount of snowfall and getting down your road could be a real challenge.

If you can’t get down your road the school bus can’t either which means kids may have more snow days in the year; I am sure they won’t mind this, but it is something you will have to plan for.

6. Having the Right Maintenance Equipment

For those winter months you may need a snowblower if you’re on a big lot with a relatively normal-sized driveway, but if your driveway is two hundred feet long or more, having a tractor with a plow might be an essential piece of equipment to purchase.

For the spring, summer and fall months you may need a riding lawnmower, or possibly a tractor with a bush hog to cut the grass.

Hiring someone to plow your drive or mow your lawn is also an option.

7. Is the Country Lifestyle For You and Your Family?

For some people buying a country home means more space and a chance to use the land by either keeping a few animals like chickens, goats, more dogs and so on. Others have the idea of growing their own fruits and vegetables in an aim to become more self-sufficient. Others simply want a bigger house, a bigger property and more privacy.

We like to make sure that, no matter what reasons our clients have for wanting a more rural lifestyle, they know what they are getting into.

Definitely consider why you think this lifestyle is for you. If you enjoy the nightlife or dining out every night and the buzz of a busy city then no, rural or country living may not be your thing.

Living on a large acreage will be work on some days, and the reality of living the countryside dream might not be as romantic as once thought. All of this said, most people considering this lifestyle are not going to mind the extra work and are likely to find it gratifying and worth it.

If you are considering buying a country home, we, and many others, recommend downloading our FREE Country Home Real Estate Guide.

Rural Home Utilities in Ontario

Moving to the countryside can be a big leap for people who have been used to a small home in the suburbs or a condo apartment in a big city.

One of those hurdles to get used to are often the utility systems that can come with country or rural living.

We have put together a little list of the utilities you might expect to find in a country home in Ontario. These are by no means extensively detailed explanations of how these systems work but rather a basic overview.

You can click on the links below to jump to your utility of interest.

HEATING

There are a variety of heating types found in country properties, from old electric systems to propane and oil systems as well. If you are not too far out of town you may even be lucky enough to be connected to a natural gas line but of course, that depends on where the nearest gas line is located. Some older properties may even rely on wood stoves and fireplaces for a portion of the heating but those are relatively rare (and also quite self-explanatory) so we won’t be covering those today.

Propane

Propane has a pretty good reputation when it comes to heating homes. It is typically a cleaner alternative to oil and quite an efficient way to heat your home when compared to natural gas or electricity. Propane is stored as a liquid in a tank outside of the home (either in an above or underground tank). These furnaces work very similarly to any other forced air furnace. Propane typically needs to be delivered to your home by a licensed company which is the only real “inconvenience”. You can also use this propane for items such as gas stoves, fireplaces, and even hot water heaters. If you’d like to get into the nitty-gritty about propane you can read more here.

Oil

Typically you’ll either find a furnace or boiler system when it comes to oil heat. In short, there is a combustion chamber where the oil is ignited and then an exchanger that warmers the gases. 1. Furnaces use a fan or flower and vents to send the warm air throughout the home. With a 2. boiler you’ll likely see a pump pushes heat through pipes to radiators. Here’s smart touch energy again with more in-depth information on how oil heat works.

Electric

Typically found in older homes. Electric heaters or furnaces aren’t very cost-effective at least here in Ontario where our hydro costs are very expensive. You’ll need to be hooked up to the grid to have this type of heat (similar to natural gas). Typically no ductwork is found if the home was originally built with the intent of heating the home via electricity. So, in homes like this, you often find that they also don’t have A/C. It is, of course, possible to remove and install a natural gas or propane furnace but ductwork will need to be added which can be costly.

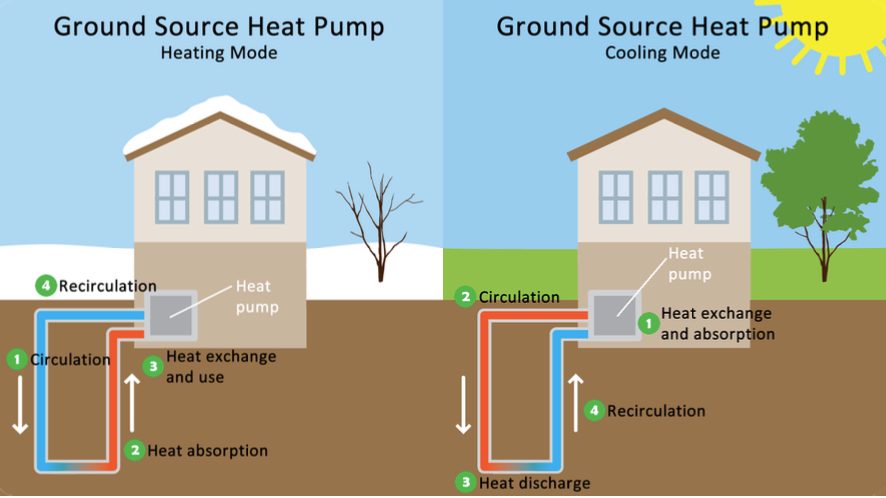

GeoThermal

There are several types of geothermal heating and cooling systems available. We won’t be going into each and every one. Here is a great guide if you’d like more in-depth details. In brief, pipes are buried into the ground below the freezing line. Both an ethanol-based fluid in the pipes and the heat from the earth are extracted and transported through these pipes into the home. The heat is then distributed throughout the home either by ducts or radiant heat.

Credit: Geothermal Heating EPA

Natural Gas

Most of you know what these are all about so we won’t go into great detail here. If you live in a relatively modern home in an urban area you could find a house that is heated via a natural gas furnace.

When it comes to heating, we sometimes see a combination of some of the above in rural and country homes. For example, you might have an electric and propane combination. We often see a lot of homes in the country with electric or wood-burning fireplaces as well which help to heat your home.

WATER

Well

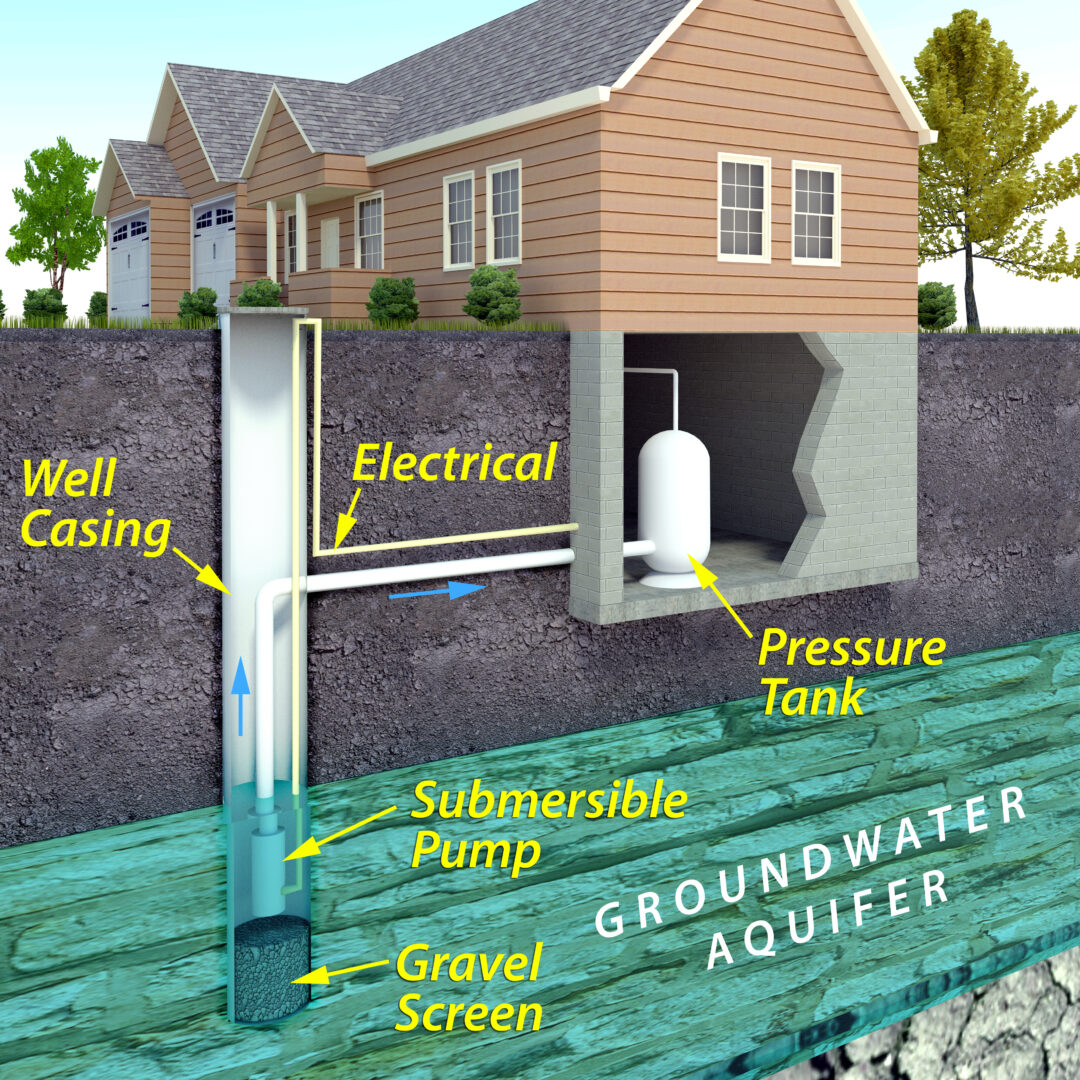

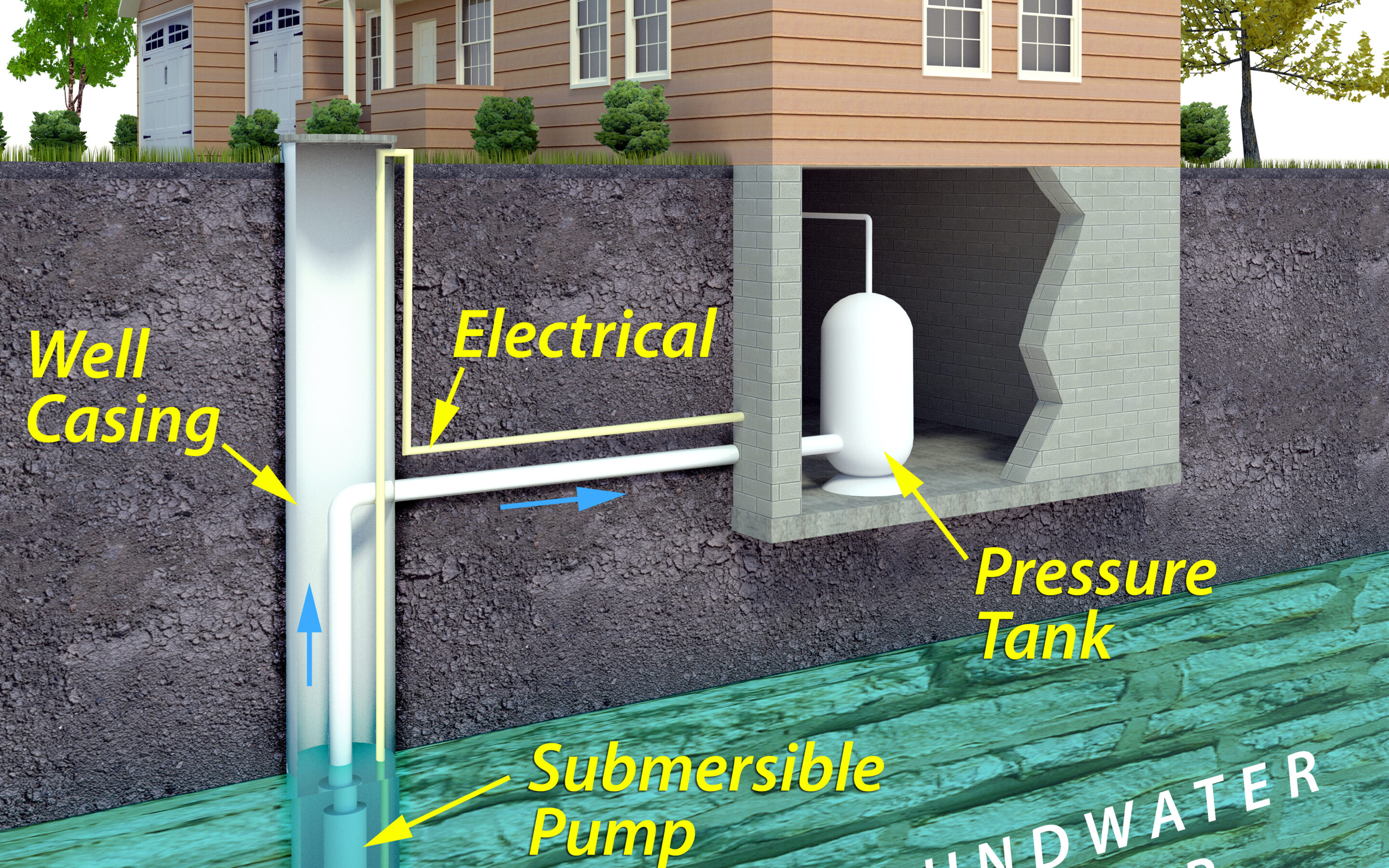

Depending on where your property is located and if there is adequate and safe groundwater, your country home will likely have a well. In short, a well is dug and a pump inserted that brings up the water from the ground and into your home. Having a useful well is great because you don’t have to pay for water. However, before you purchase a property it is essential that you have an inspector inspect the well and get well tests done to ensure it is safe for drinking and not contaminated. For more details click here.

Cistern

When your property does not have adequate or safe drinking water you’ll likely have a cistern. Essentially there is a holding tank that either collects rainwater or you can purchase the water yourself and have it trucked into your property. If you have ever seen the trucks with tanks on the back that say something like “Ed’s Water Haulage”, “Ed” is trucking water to someone who has a cistern that needs filling.

Municipal

There are country homes that, if not located too far outside of town, are or can be connected to the local water system. This makes things simple for those moving from the city to the countryside.

SEWER

Septic System

In the countryside, it is common to have what is called a septic sewer system. There are quite a few different types of septic sewer systems, but the most common one in Ontario is the septic holding tank combined with some type of absorption system such as a leaching bed, where liquids are filtered through and then absorbed back in the ground. The solids and sludge in the tank will require an outside service company to visit the property from time to time to suck out all the contents with what is basically a giant vacuum on the back of a big truck. There will be a cost for this service so it is something to budget for. As the property owner, the condition of this system will be your responsibility, so being careful with what you flush or dump down the drain will be something you will want to educate yourself on. You can read more here.

Municipal Sewer

Again, if the property is located close to city limits you might be lucky enough to be connected to the local sewer system meaning you don’t have to worry about maintaining or keeping an eye on your septic system. However, you are then connected to the grid.

Electricity

This system is pretty straight forward. Unless you are building a house that you have to fly in a bush plane to get to, you will most likely be connected to the electrical grid.

One potential opportunity though would be to supplement your electricity by creating your own! This will be site and location dependent. But if your plot is right, you may want to explore, solar and wind as possible systems to create some of your own power. If your property and systems are large enough you might even be able to obtain a contract with the Ontario government to sell electricity back to the grid. This would require a real cost to benefit analysis, as large scale systems are expensive and you are required to pay for the system yourself. Speaking to an expert will give you clarification on whether this is a viable option worth entertaining.

If you have any questions, reach out.

Avoid Buying Your Country Home Near Future Development

A longtime friend of mine has owned a farm on the border of Fonthill. A farm that has been in their family for generations.

Aside from a few country properties across from and neighboring them, they enjoy wide-open spaces in a wonderful rural setting.

Well, they did until a few years ago.

A farm down the road sold to a developer and because this particular area is not within the Greenbelt protections, the developer had no trouble changing the zoning and building a subdivision.

My friend and her husband had not seen this coming. Unfortunately, in most cases, it is extremely difficult to guarantee that your rural property will be safe from nearby development.

But, arming yourself with knowledge on the area you are buying in could help mitigate SOME of the risk.

Here are some tips:

Living in Protected Areas

Buying a country home in a protected area like the GreenBelt could thwart some of the risk of waking up to bulldozers on the property beside you.

Of course, this could change at any time but we hope not.

Properties protected under the Niagara Escarpment Commission or Oak Ridges Moraine Conservation Plan may provide you some protection as well.

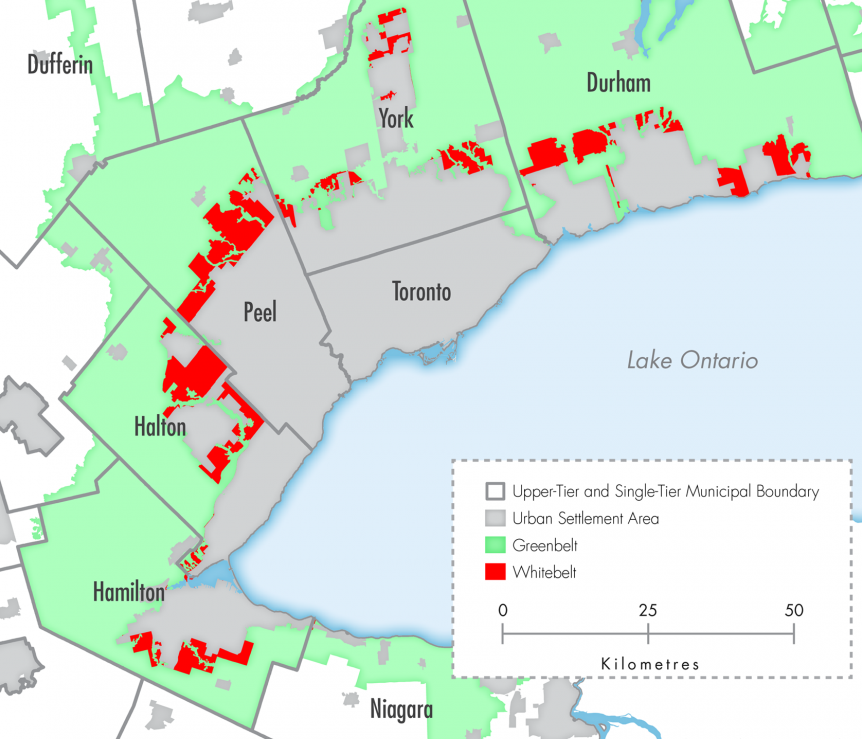

Again, it is impossible to give you a guarantee that things will not change in the future. Take a look at this MAP showing over 600 requests and accompanying reasons to remove specific sections of land from the Greenbelt.

Now, bear in mind that living in these areas may also make it difficult to make changes to the home and property itself.

You will likely need permission and approval from conservation authorities and environmental protection agencies to add extensions, build new buildings and even remove trees on the property.

Contact the Ministry of Natural Resources and Forestry to get more information on types of property protections and how these can help you.

Connect With The Local Municipality

The local municipality should be able to confirm current land zoning, future use and planning allowances for your property of interest and the properties surrounding it.

Investigate to see if there are any applications to change the zoning of properties near your home of interest and go from there.

Be Wary of Buying near Major Highway Corridors

Towns along the 401 and 400 highways have been seeing a large amount of development over the last number of years.

The 401 towards London, in towns such as Woostock and Ingersoll, have seen growth in the number of subdivisions being built.

Interestingly, Stratford and St. Mary’s – two quaint towns set a little ways back from the highway – are seeing an increase in the rezoning of agricultural land on the outskirts of town as well. All to accommodate more housing developments.

New Techumseth, recently making the ‘Top 25 places to live in Canada’ list, is definitely one to watch. Most of the community is outside of the Greenbelt protection and only just a 1hr drive to Mississauga and 1hr30 minutes to downtown Toronto.

Be Wary of Buying Country Homes on The Edge of Town

This is best described with an example. We’ll use Niagara.

Generally, the Niagara Region has a tight plan when it comes to development.

The municipality has been consistent with protecting agricultural land and conservation areas from housing developments.

However, the 2013 Niagara’s GreenBelt Review Summary presented questions as to why First Street Louth and Fourth Avenue (where the new St Catharines General Hospital was built) were still included in the Greenbelt despite the growing amount of development surrounding these streets.

The Louth neighbourhood that encompasses these streets – just on the southeastern outskirts of St Catharines – is primarily dominated by agricultural properties, wineries and a number of country homes as well.

As far as I know, there are NO plans in place for developers to buy up the land here.

But without a crystal ball (and maybe even with one) it is tough to tell what could happen with so much development just a stone throws away from these streets.

Investigate The Growth Plan & Unprotected Lands.

The WhiteBelt includes sections of undeveloped land that lie between existing urban settlement and the greenbelt. This land is currently being used for agricultural and rural uses. See below in Red.

The Growth Plan 2017, is a strategic policy set out as a sort of blueprint for urban and economic growth around the Golden Horse Shoe. This is a Map excerpt from the 2017 Growth Plan document showing the potential use of the Whitebelt for urban growth and expansion.

Currently, these lands have not been designated for urban use but they do not have the protection of being in the Greenbelt either. If you are buying a country home within or bordering on the Whitebelt, investigate with municipalities, environmental agencies and conservation authorities to see what the future may hold for these properties.

It is easy to speculate about future development but difficult to get it exactly right 100% of the time. The tips given above are just that, tips. Many country properties are located within protected areas and frankly, the chance of having a subdivision spring up next door is relatively slim.

But it doesn’t hurt to do your due diligence before you buy any property.

Let these tips serve as a simple guide to help you decide where the best place to buy a country home might be for you.